“It is our duty to fight for our freedom. It is our duty to win. We must love each other and support each other. We have nothing to lose but our chains.” —Assata Shakur

On June 19, 1865—more than two years after the Emancipation Proclamation—enslaved Black people in Galveston, Texas, finally received word that they were free. Juneteenth marks the day federal troops enforced the end of slavery in the last Confederate state. But in reality, that freedom didn’t come with full rights, safety, land, or opportunity. The 13th Amendment, ratified a few months later on Dec. 6, 1986, formally abolished slavery—but with a loophole: it allowed slavery and involuntary servitude “as a punishment for a crime.” That exception clause created a legal basis for the continued forced labor of incarcerated people, a practice that persists to this day and disproportionately impacts Black communities. And still, the promise of that freedom remains unfulfilled.

Since then, Juneteenth has been a celebration of Black liberation—and a reminder of the systems that delay, deny, and distort it. It’s a day to reflect on survival, joy, and resistance. But it also demands that we name the uncomfortable truth: the end of chattel slavery was not the end of racial exploitation. It just changed form.

Today, capitalism, tax policy, and economic systems still function as tools of racial control. And while it might be uncomfortable to say that out loud, we can’t move forward unless we do. If we’re going to talk about freedom, we also have to talk about how the U.S. economy was built—who it benefits, who it exploits, and why.

That’s why we’ve partnered with Soul 2 Soul Sisters, a Black-led spiritual and political organizing collective, to examine the racist roots of tax policy, the legacy of exploitation, and the work of repair.

During Reconstruction, Black Americans began building power—holding office, founding schools, fighting for public goods. But that progress sparked a coordinated and violent backlash. That backlash came through lynchings and Jim Crow laws—but it also came through tax policy.

In the late 1800s, most local services were funded by property taxes. Because newly freed Black families didn’t own land, white lawmakers slashed property tax rates and capped revenue growth, gutting public institutions Black legislators were trying to build. This wasn’t just about money—it was about power. Undermining Black-led governance became a fiscal project. The Center on Budget and Policy Priorities gives the following examples:

This Isn’t Just History. These Systems Still Shape Our Lives.

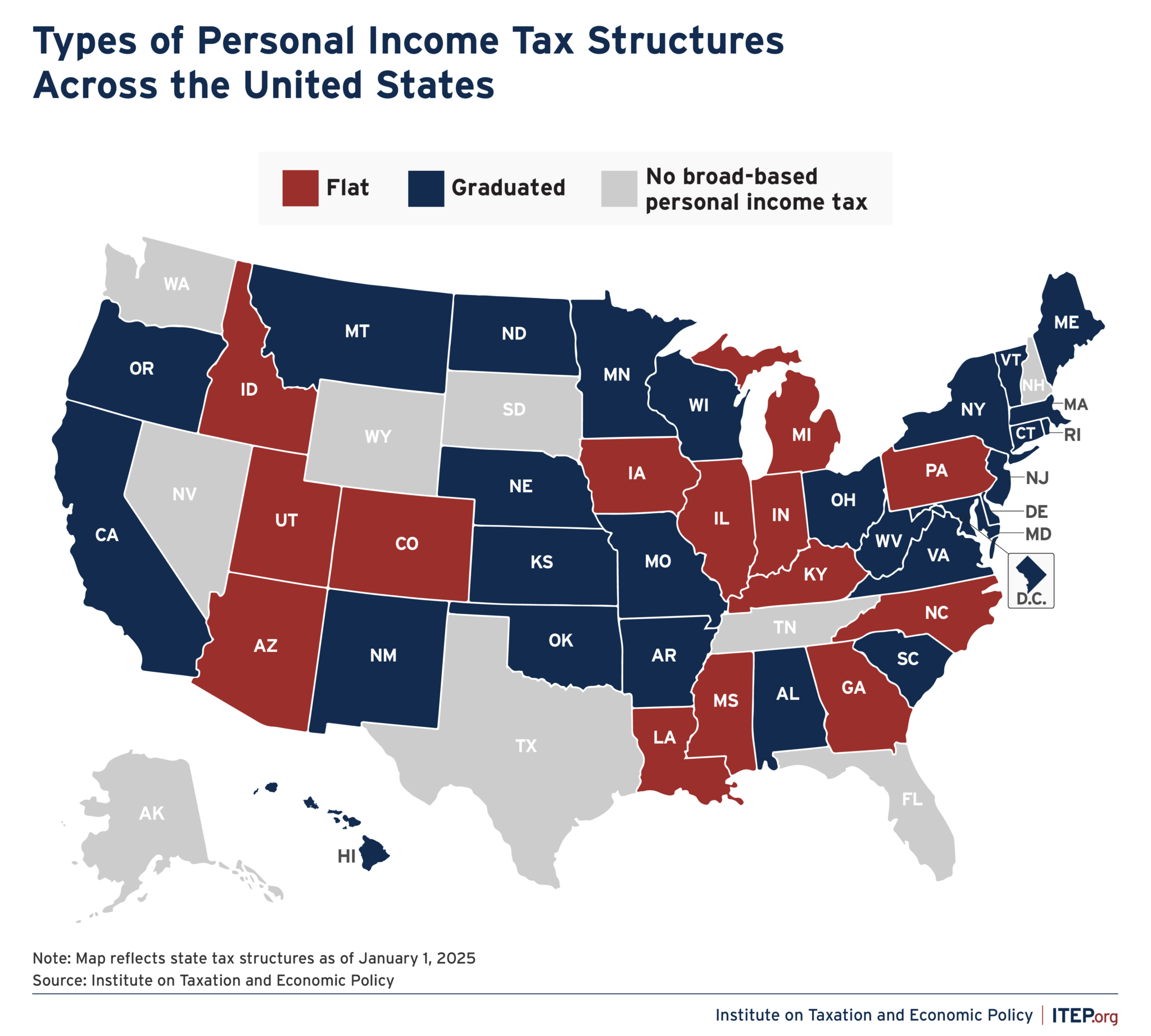

Today, state and local tax systems in 41 states are still regressive, or upside-down: lower-income households pay a larger share of their income in taxes than the wealthy do. Since Black and brown families are overrepresented in lower income brackets, the impact is disproportionately racialized.

And unlike many other states, Colorado’s constitution bans a graduated income tax, which is one of the best tools we have to create a fairer tax system. Unless we amend the constitution, we’re stuck with this inequitable structure.

From audits to asset building, tax policy continues to disadvantage Black families and communities:

Capitalism doesn’t just rely on inequality—it manufactures and maintains it. And tax policy helps it do so.

The fight for racial justice has always included demands for economic justice—from the Montgomery Bus Boycott, to the Black Panther Party’s free clinics and breakfast programs, to the March on Washington for Jobs & Freedom, organized by A. Philip Randolph and Bayard Rustin. This tradition continues today through Black-led unions, mutual aid networks, cooperatives, and policy organizing.

As Tricia Hersey, founder of The Nap Ministry, puts it: “Capitalism may not fall in our lifetimes, and it is not redeemable, so the work is to begin to reclaim your body and your time in ways that seem impossible to imagine.”

Capitalism may not fall in our lifetimes, and it is not redeemable, so the work is to begin to reclaim your body and your time in ways that seem impossible to imagine.”—Tricia Hersey

During Pride Month, we must also name the ways the tax system—and capitalism more broadly—erases and harms LGBTQIA+ people, especially those who are Black, brown, trans, or undocumented. When benefit structures exclude chosen families, when housing discrimination and healthcare gaps persist, and when queer people are funneled into the informal or underpaid economy, they are subject to the same cycles of exploitation and exclusion.

Colorado has already taken some bold steps. In 2020, we passed House Bill 1420, also known as the Tax Fairness Act, closing corporate tax loopholes and expanding the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC)—two of the most effective, race-conscious anti-poverty tools available.

But more is needed:

This Juneteenth, our fight feels even more urgent. Congress is currently considering the One Big Beautiful Bill Act (OBBBA)—a sweeping proposal that would gut healthcare, food assistance, and clean energy investments to give massive tax cuts to millionaires. If passed, the OBBBA would:

It’s one of the most devastating wealth transfers in recent history—from working families to the ultra-wealthy. This isn’t about fiscal responsibility. It’s about protecting privilege and punishing the poor. And unless we push back, it could become law.

We can’t just celebrate Juneteenth—we have to fight like hell to make its promise real. Another world is possible. Let’s build it.

Colorado Fiscal Institute © 2011-2025. All Rights Reserved. Privacy Policy