By Keirin Gonzalez

With the Dec. 15 insurance enrollment deadline approaching, many people are already facing steep increases in premium prices. With the expiration of extensions to the Affordable Care Act (ACA) Premium Tax Credits (PTCs), millions enrolled in Marketplace plans will see their health insurance premiums rise–and in many cases, more than double.

The ACA, signed into law in March 2010, aimed to do three things:

PTCs are refundable tax credits that help eligible individuals purchase subsidized health care plans on the marketplace. Insurance premiums are quoted based on a sliding scale–PTCs then cover the difference between what the individual is expected to contribute and the actual cost of the plan. That contribution is set by the family’s income–so lower earners pay less than higher earners. During the COVID-19 pandemic, Congress passed the American Rescue Plan Act (ARPA) of 2021, which expanded eligibility for higher-income earners and reduced contributions for families across all income levels. This expansion increased access to health care for millions of people who were struggling to afford insurance.

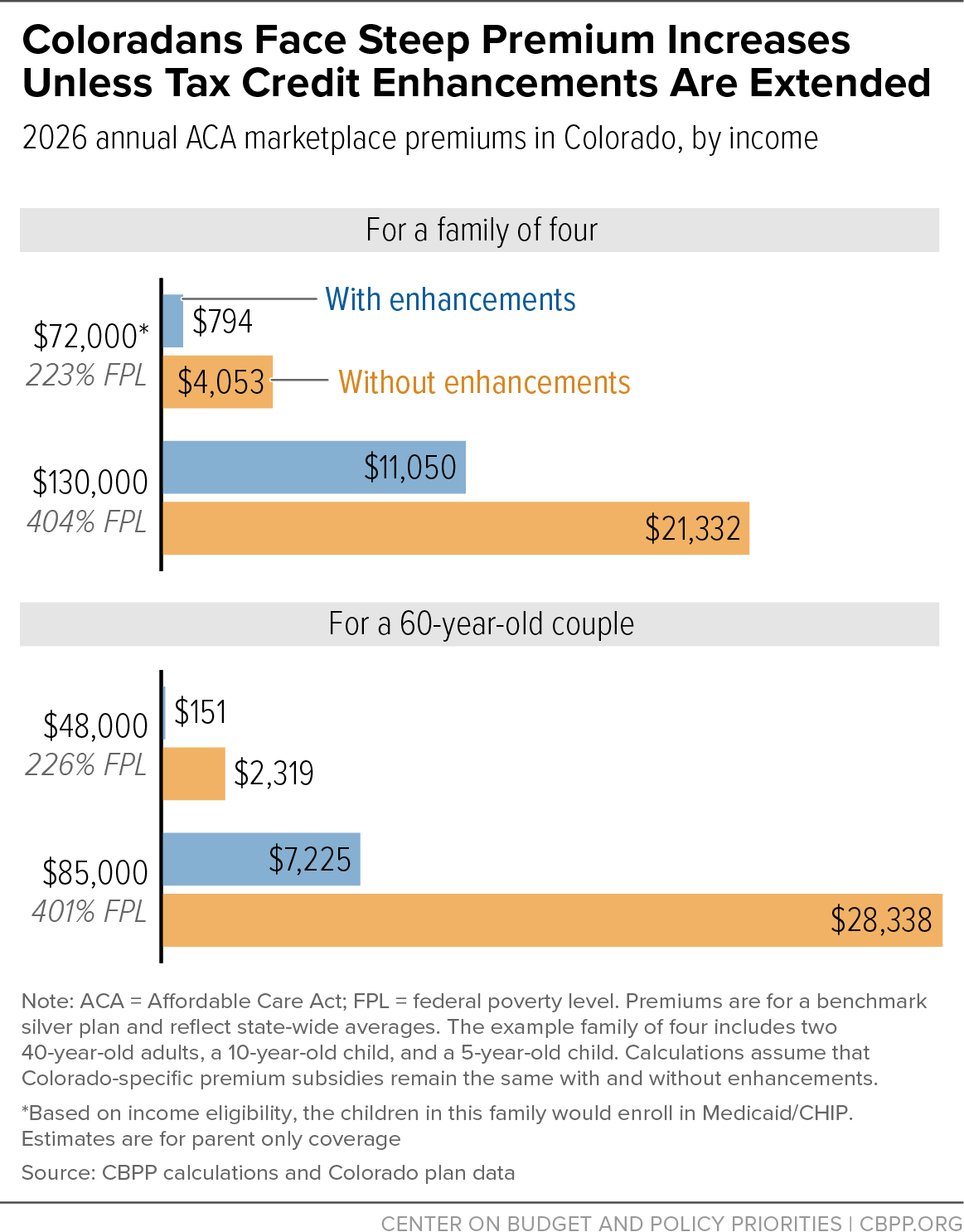

Let’s look at some examples:

The expansion to PTCs under ARPA is set to expire at the end of fiscal year 2025. When that happens, premiums for 20 million Americans will increase beginning in January 2026. Many elected officials have advocated for extending PTCs permanently. However, a lack of agreement led Congress to fail to pass a funding bill before Oct. 1, 2025, resulting in the government shutdown.

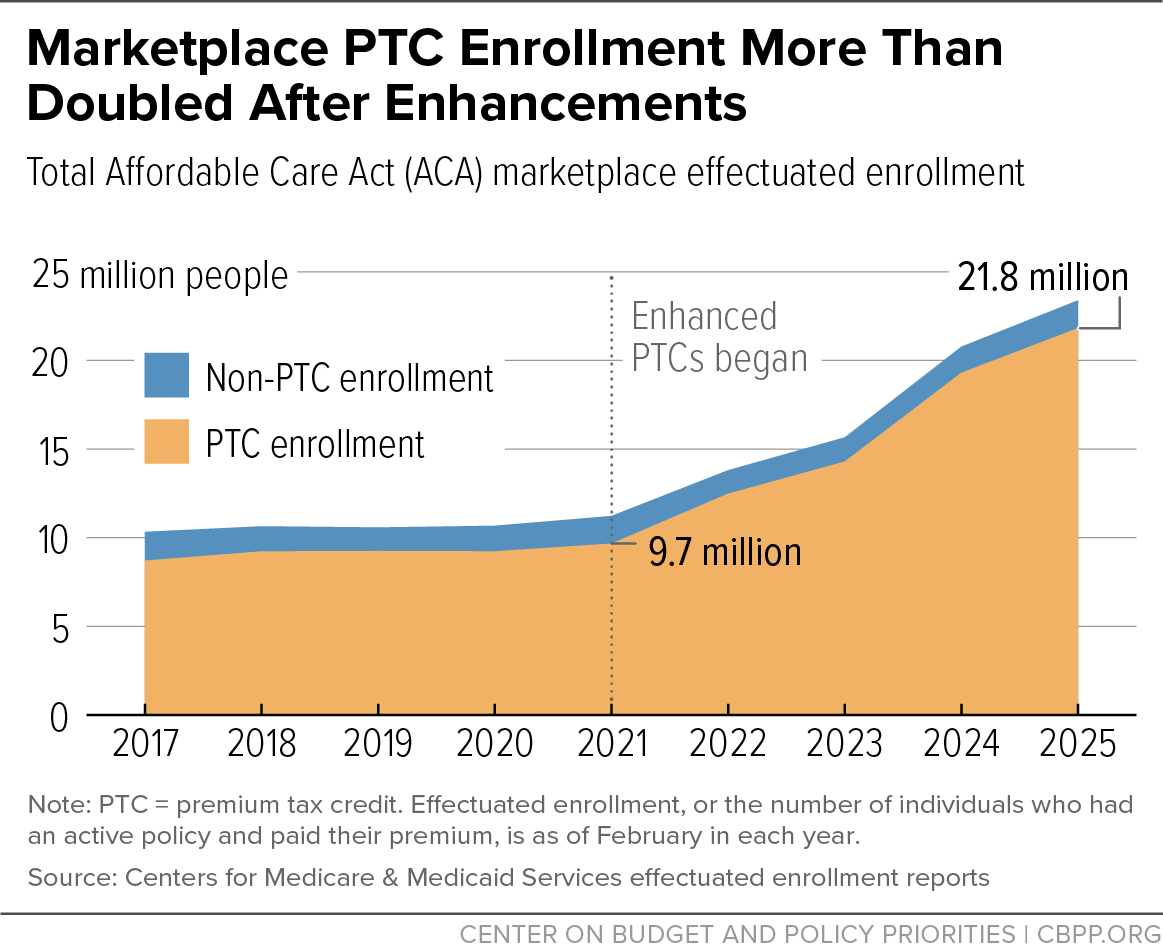

By 2025, enrollment through ACA marketplaces totaled around 23.4 million people—double the amount in 2020, totaling 11.4 million. This indicated a growing need for health insurance subsidies as more people rely on Premium Tax Credits (PTCs) to afford health care. Specifically, low-income people make up the vast majority of growth in the ACA marketplaces, further highlighting the unaffordability of health care.

With the end of the extension to Premium Tax Credits (PTCs), premiums will increase for most of these individuals and their families. Without these subsidies, premium costs would double or more than double for many. Subsequently, lower-income enrollees would see the steepest premium increase. For example, a 45-year-old enrollee making $25,000, currently paying $160 for their annual premium, would now be paying up to $1,077 per year without the subsidy—a 573% increase.

With higher premiums, more people will opt out of coverage. An estimated 3.8 million fewer people will have health care due to its unaffordability. As more people become uninsured, it increases the risk for those who are reliant on health care, as it increases premium costs for people without subsidies. When there are fewer people reliant on a service—in this case health insurance—the price goes up, making it more expensive for people who rely on services.

As services are still needed, state and local governments will likely see a strain as many uninsured require medical care—placing a strain on hospitals’ budgets, which must cover the unaccounted-for care.

People will get sick and use medical services regardless of whether they have insurance. What changes is when and where they seek care: uninsured people often delay treatment until their conditions worsen, and then they go to emergency rooms. Because preventive care isn’t accessible to the uninsured, they are often sicker when they seek care and generate higher uncompensated care costs for hospitals, straining their budgets. State and local government then absorb much of this burden through public hospital funding. In this way, the loss of insurance triggers a domino effect that impacts not only the individual but also providers, hospitals and government budgets.

These changes to health care subsidies could leave millions uninsured, stripping people of access to basic care and treatment. It is crucial to advocate for an extension of PTCs, as they remain a vital bridge to affordable and accessible health care. With a re-vote on PTC extensions approaching, contact your local legislators and urge them to support policies that keep health care accessible and affordable for the people they serve. Stay connected with the Colorado Fiscal Institute’s resources and join us in advancing people-centered policy.

Instituto Fiscal de Colorado © 2011-2025. Todos los derechos reservados. Política de privacidad