This Parents’ Day Colorado’s Tax Code Should Work for Families

By: Caroline Nutter and Ealasha Vaughner

How the EITC and CTC support Colorado Parents

As we celebrate Parents’ Day this weekend, Colorado should reflect on how our policies can help or hurt families. This includes our tax code, where we have abundant opportunities to make parents’ lives even better.

Colorado parents are struggling. The COVID-19 pandemic highlighted this as an inescapable truth. Despite federal and state relief efforts, caregivers were laid off and household bills piled up. Families rationed necessities like diapers and formula in order to keep a roof over their heads. The percentage of parents lacking secure employment leapt from 26% to 29% nationally from 2019 to 2021. Parents who were fortunate enough to retain their jobs had to balance a full work-day with full-time childcare and virtual school duties. Between 2019 and 2021, the number of children in poverty increased by over 5,000, or almost 4%.

In 2023, three years after the pandemic began, working families are still trying to catch up in an economy that has not been built for them. The average cost of childcare in Colorado is $16,333, the fifth-highest in the nation. Infant care in Colorado costs more than in-state tuition in 34 states. Nationally, 13% of families had job changes between 2020 and 2021 due to childcare costs. Childcare expenses are especially burdensome to mothers, and mothers of color often feel the struggle most. Sixteen percent of families with single mothers had job changes due to childcare costs.

Over the last 20 years, CFI, Clayton Early Learning Community Ambassadors, and countless other partners and organizations, advocated for changes in the tax code to provide targeted relief to parents and their kids through low-income tax credits.

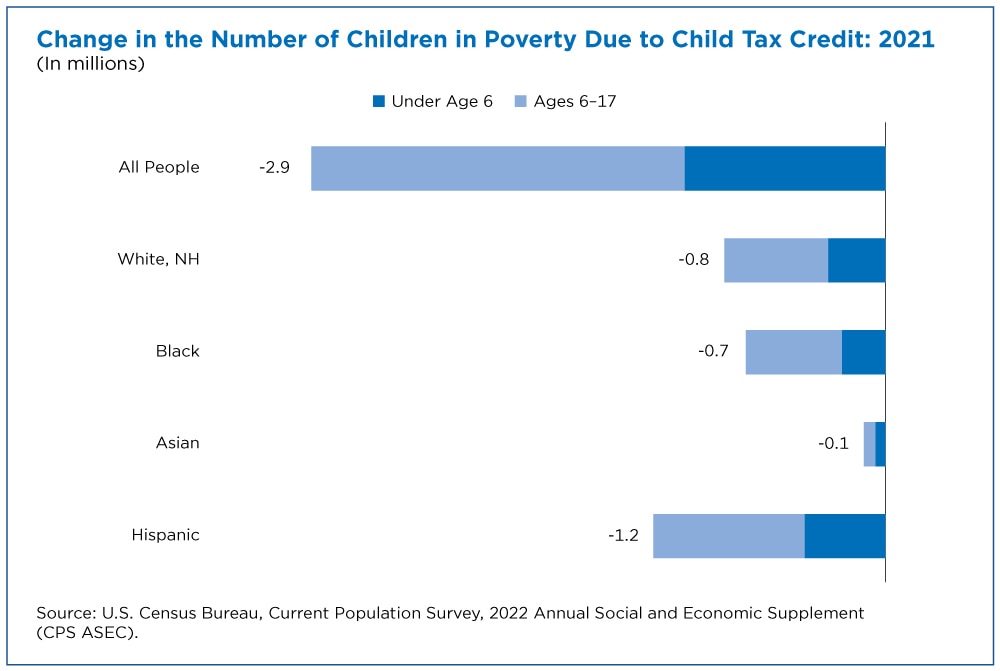

Two in particular, the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC), are critical safety net policies for parents. In 2018, the EITC lifted about 5.6 million people out of poverty, including about 3 million kids. In 2021, the Biden administration expanded the CTC to the lowest earners and expanded the credit amount under the American Rescue Plan Act (ARPA), cutting child poverty by 30%.

Colorado has its own EITC and CTC, both of which are modeled on the federal credits. During the 2023 tax season, families with children under the age of six who met the income requirements received a state-level CTC from Colorado for the first time, thanks to work done in the legislature in 2021. This year, the legislature passed a bill that will further expand the Colorado CTC, as well as increase the amount of the Colorado EITC. Families who qualify will see an increase in the EITC from 25% to 38% of the federal credit when they file their 2024 taxes, and the CTC to between $200 and $1,200 per child, depending on the income of the taxpayer. The changes made to the Colorado CTC in 2023 will also include or increase the benefit for 65,000 kids across the state that had previously been excluded, putting an additional $45 million into the hands of families earning the lowest incomes.

A Testament to the Impact of Tax Credits

EITC and CTC are crucial for strengthening families and community members in Colorado. These benefits not only encourage people to work but also boost their self-confidence, thereby leading to an increase in the economy. Additionally, they promote workforce participation and encourage low-wage workers to get additional education or training to improve their employability and earning potential.

EITC and CTC are crucial for strengthening families and community members in Colorado. These benefits not only encourage people to work but also boost their self-confidence, thereby leading to an increase in the economy. Additionally, they promote workforce participation and encourage low-wage workers to get additional education or training to improve their employability and earning potential.

As a single mother of two, I understand the challenges of keeping up with a monthly budget. Unfortunately, things do not always go as planned. Unforeseen circumstances tend to arise, such as my kids outgrowing their clothes and shoes, or unexpected car repairs. These are the obstacles working families face daily. That is why receiving tax credits like the EITC or CTC is a huge help for parents and families like mine. They can help us stay afloat, avoid debt, and even help reduce debt we already have.

The EITC and CTC effectively lower poverty rates, while aiding families who experience the Cliff Effect. The Cliff Effect refers to the unintended consequence of a pay raise resulting in a significant reduction of government assistance. Even a minor increase in income can cause some to lose access to subsidized benefits such as healthcare, housing, or childcare. This sudden loss can leave families worse off than they were before. These tax credits provide a lifeline for families like mine who are currently experiencing the Cliff Effect, or simply struggling to make ends meet. They enable us to purchase necessities, such as food and housing.

Studies have shown that utilizing certain tax credits can not only enhance a child’s immediate state of well-being, but also result in positive long-term effects, such as improved health and increased earnings during adulthood. As someone who has personally benefited from this, I can attest to its effectiveness. With my EITC and CTC, I was able to enroll my two daughters in extracurricular activities, thereby boosting their self-assurance, social skills, and knowledge in areas they might have otherwise missed due to financial barriers.

Getting an extra few hundred dollars from my EITC and CTC makes a significant difference for my family. These credits are essential for families to make ends meet. They improve economic security, enhance children’s educational performance and attainment, and promote better health outcomes. Moreover, they provide a short-term safety net to help families achieve sustainability.

The tax code can be a powerful tool for lifting struggling parents and their children out of poverty. Data and stories from parents continue to show the tremendous impact the EITC and CTC have on Colorado families. With the recent expansions of these credits during the 2023 legislative session, Colorado now has one of the most generous CTCs in the country, a true testament of the power of collective advocacy on proven tax policies. Colorado must continue to pass tax policies that uplift working families and our economy, ensure protection of these recent gains, and work to expand the EITC and CTC even further.

About the Authors:

Caroline Nutter is the Legislative Coordinator at the Colorado Fiscal Institute. Caroline researches and analyses state fiscal policy issues and advocates for policies that bring equity and prosperity to all Coloradans.

Caroline Nutter is the Legislative Coordinator at the Colorado Fiscal Institute. Caroline researches and analyses state fiscal policy issues and advocates for policies that bring equity and prosperity to all Coloradans.

Ealasha Vaughner is the Manager of Policy and Advocacy at Clayton Early Learning. A Colorado mother of 2, Ealasha is a recipient and longtime advocate of targeted tax credits like the EITC and CTC.