Income Tax Rate Reduction Benefits Highest Income Coloradans Most

Impact of an income tax rate reduction from 4.63 percent to 4.49 percent

The wealthiest see the greatest reduction

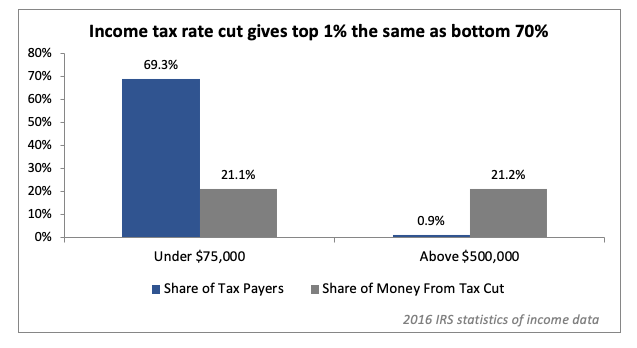

Reducing the Colorado income tax rate from 4.63 percent to 4.49 percent, the amount proposed in recently introduced legislation at the state capitol (SB19-055), will mean $280 million less for essential public investments. That’s because the income tax is the largest revenue source for the General Fund – the part of the state budget responsible for funding schools, Medicaid, colleges, courts, prisons, and human services. This retreat of state support would affect the budgets of all Colorado families, making it more difficult for them to make ends meet. And while proponents of tax cuts claim they provide “relief” to Coloradans, the top 1 percent would see the amount they pay in taxes fall by a greater amount than the dollar amount of the reduction for the bottom 70 percent of taxpayers.

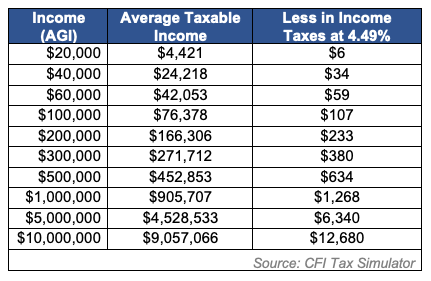

Put another way, because an across-the-board income tax rate reduction reflects the current concentration of the incomes of Colorado taxpayers, those earning $1 million will see their tax bills fall by around $1,250 while the tax obligation for a worker earning the minimum wage will be reduced by just $6.

Reduces taxes paid by corporations

Despite Colorado ranking third-lowest among states with a corporate income tax, SB19-055 would shrink taxes paid by corporations by $24 million. The reduction would also come at a time when corporations’ tax bills were slashed by recent changes to the federal tax code. Research recently published by Harvard Business School found reducing corporate taxes actually ends up exacerbating income inequality and doesn’t help workers who earn less than $200,000 per year.

25% of Coloradans won’t pay less in taxes

In addition to the income inequality issues mentioned above, because a portion of Colorado taxpayers have higher deductions than taxable income (and thus zero income tax liability), an income tax rate reduction has no effect on fully 25 percent of Colorado taxpayers. The income tax rate doesn’t matter to a taxpayer with zero income tax liability because the rate is applied to zero dollars; meaning they owe no income tax. Of those 672,000 taxpayers with no income tax liability, more than half have incomes below $25,000, and 80 percent of them make less than $46,000.

Cutting the income tax rate increases the upside-down nature of Colorado’s tax code

The wealthy pay a smaller percentage of their income in taxes

In addition to income taxes, Colorado taxpayers also pay sales and property taxes. The sales tax is the most regressive part of Colorado’s tax code. A household making $32,000 a year pays 5 percent of their income in sales tax, whereas a millionaire pays sales taxes totaling less than 1 percent of their income. Coloradans earning low incomes also pay a high rate of their income in property taxes compared to wealthier households. Overall, people in households earning $32,000 pay 9 percent of their annual income in state and local taxes. Compare that to households earning $400,000 a year, who pay around 6 ½ percent of their incomes in state and local taxes.

Reduces funding for important priorities

The tax rate reduction proposed in SB19-055 also jeopardizes resources to fund current priorities such as full-day kindergarten. The price of that important enhancement is approximately $227 million. If a reduction in the income tax rate was to pass, the resources for paying for tuition-free kindergarten would be wiped out of future budgets. This would needlessly pit budget priorities – like paying for the salaries of kindergarten teachers or paying for other public school teachers – against one another.